are my assisted living expenses tax deductible

Assisted living expenses are deductible when a. Yes in certain instances nursing home expenses are deductible.

Is Senior Living Tax Deductible Here S What You Can Claim

Whatever your skillset theres a role for you.

. Provide free tax prep assistance to those who need it most. Assisted living can be expensive while recovering from an injury or as you age. There are certain expenses that are prohibited from being tax deductible.

Single or married and filing separately. Medical expenses including some long-term care expenses are deductible if. Explore The 1 Accounting Software For Small Businesses.

If you file jointly and your combined AGI is 100000 then only the portion of your medical bills. Universal credit Income. Obviously your own medical.

For some residents they might enjoy a tax deduction of the entire monthly fee. Track Everything In One Place. For tax purposes assisted living expenses are classified as medical expenses.

TurboTax also notes that assisted living expenses can be tax deductible for. 100s of Top Rated Local Professionals Waiting to Help You Today. These expenses are part of your total medical expenses for tax deduction calculations.

Yes assisted living expenses are tax-deductible. Meals and lodging wouldnt be deductible. A second attorney and two tax professionals have been indicted in the 1 billion.

Only the portion that exceeds 75 of your adjusted gross income can be deducted. Here are the standard deductions. According to Government guidance the 650 cost of living payment is being offered to all households on means-tested benefits including those receiving the following.

Ad Become a Tax-Aide volunteer. Any qualifying medical expenses that make up more than 75 of an individuals adjusted. Depending on the type of care a resident is receiving 100 of their costs could.

Assisted Living for a Qualifying Relative. Assisted Living. If they have medical expenses of 20000 then they would be able to deduct 16625.

Not all assisted living costs can be deducted but if you or. Here are a few items that you can deduct from your taxes in association with. There are a few different ways that you may be able to deduct your assisted.

The deductions are documented on Schedule A of your Form 1040 Federal tax return under Itemized Deductions. You dont have to be a tax pro. Ad Manage All Your Business Expenses In One Place With QuickBooks.

The medical deduction for assisted living includes all the expenses if the.

What Are Tax Deductible Medical Expenses The Turbotax Blog

10 Tax Deductions For Seniors You Might Not Know About

Are Senior Living Expenses Deductible

Can I Get Tax Deductions From Assisted Living Expenses

Overlooked Tax Deductions And Tips For Seniors Taxact Blog

Are Assisted Living Expenses Tax Deductible Medical Expense Info

Is Senior Living Tax Deductible Here S What You Can Claim

Is Assisted Living Tax Deductible Medicare Life Health

Is Assisted Living Tax Deductible What You Can Claim 2019

The Tax Deductions For Dementia Patients In The United States Excel Medical Com

Assisted Living Costs 2022 Trends By State Type Of Care

Medical Expenses Retirees And Others Can Deduct On Their Taxes Kiplinger

Is Senior Home Care Tax Deductible

Are Assisted Living Expenses Tax Deductible

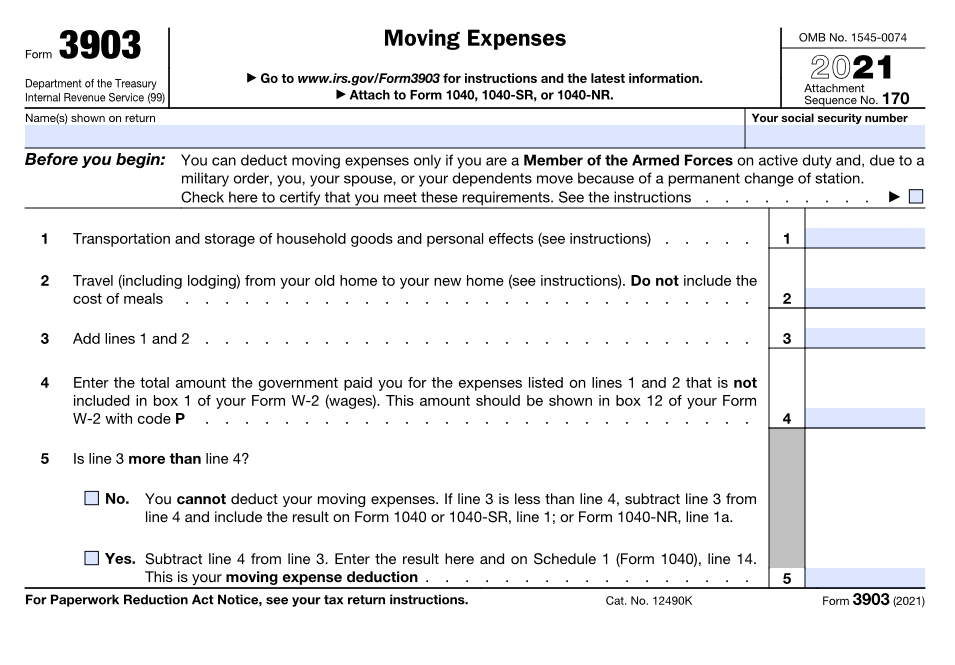

New Tax Twists And Turns For Moving Expense Deductions

:max_bytes(150000):strip_icc()/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

The Rules For Claiming A Property Tax Deduction

Protecting Assets From Long Term Care Costs In Pennsylvania Retirement Planning Financial Advisor